Based on my analysis, the average price of single-family active listings in Greenwich has to drop between 30% to 38% to match the rent and sale ratios of single-family properties sold this year through the end of March. The median price of active single-family properties has to drop 23%.

98 of more than 660 single-family properties were listed as both for sale and rent at the end of March or about 1 in 6 1/2 properties. A summary of the average asking rents and list prices of the 98 properties, broken down by section of town, is found in Table 1 (note that the Grand Averages are calculated by column and do not add-up across rows).

'

Eight of twenty-six single-family sales this year through the end of March were listed as both for sale and rent. A summary of the eight properties is in Table 1a.

'

While the 98 active listings are a decent sample, the 8 sales are less so. But it is the best available; so I'll work with it. The results of applying the number of years rent for which a property sold (the "Sale/Rent" ratio) and the modified capitalization rate ("Rent/Sale" ratio where gross rents are divided by sale price) of the sold properties to the active listings are in Table 1b.

.

The total average asking rent for all active single-family listings here is $130,779 per year. The average single-family home sold at 19.63 times its annual rent (those rents are a combination of either last ask rent, actual rent in place immediately prior to sale, or new ask rent rate in cases where property sold in '09 and was put back on market for rent). At 19.63 times the total average asking rent, the average active single-family listing would sell at 30% less than the current average ask price, or $2.57mln rather than $3.65mln.

The properties that sold year to date have an average 5.75% modified capitalization rate. Applying this average modified cap rate to the average active rent of $130,779, we get a $2.28mln value. This amount is 38% lower than the $3.65mln current average active list price. Active listings would have to drop 38% to achieve the same capitalization rate as year-to-March sales (for these exercises that rents are kept constant).

.

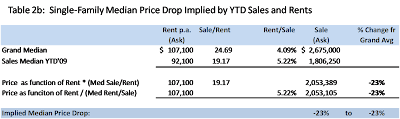

As a check, I present an analysis of the median data below. Median active asking rent for single-family houses for both sale and rent is $107,100 per year or $8,925 per month. Single-family properties sold this year through March closed at a median price of $1.81mln, at 19.17 times annual rent and at a median modified cap rate of 5.22%. The median active listing price would have to come down 23% to match year-to-date sale and rent ratios.

While I focus the analysis on single-family prices here, the rent to sale numbers above seem to indicate that renting may be a good financial decision for a while longer. I mean is it a wise financial decision to buy a property that sells at 28 times current ask rents? I'll look into rents in a future post.

No comments:

Post a Comment